Strengthening Our European Presence: The Strategic Benefits of Our Partnership with Alpha Bank

Monday 06 October 2025

At UniCredit, we are committed to building sustainable value for our clients, shareholders, and the communities we serve. Our strategic partnership with Alpha Bank represents a significant milestone in this journey, demonstrating how we can unlock new opportunities across European markets.

Expanding our footprint in high growth markets

Through our partnership with Alpha Bank, we are strengthening our presence in two key European markets with exceptional growth potential. In Romania, we are enhancing our already established operations, while in Greece, we are expanding our product and platform reach into a market that has undergone significant structural reforms and returned to robust growth.

This positioning allows us to better serve our clients' cross-border needs while capturing the growth opportunities that these dynamic markets present.

Creating Value Through Strategic Collaboration

Our partnership philosophy centers on mutual benefit and shared expertise. By working together with Alpha Bank, we are supporting their strategic objectives while enhancing their franchise value through our expanded product offerings and accelerated business plan delivery.

The collaboration enables Alpha Bank to strengthen its customer service capabilities by accessing our extensive know-how and leveraging our established presence in key European markets, including Italy, Germany, and throughout Central and Eastern Europe. This knowledge sharing creates a more robust banking experience for customers across both organizations.

Extending the Reach of Our Product Factories

Our client strategy is focused on the combination of our unique local presence across 13 countries with our scale, which enables us to develop best-in-class products and services. The partnership with Alpha Bank serves as a natural extension of our on-the-ground presence, leveraging on its strong local relationships in both Romania and Greece, enabling us to roll out our products in these fast-growing markets. To take asset management as an example, as of 1H25, we had distributed more than €570m in onemarkets funds to clients in Greece, demonstrating the quality of the product and the value for clients in the country.

Building Market Leadership in Romania

The merger of Alpha Bank Romania with UniCredit Bank Romania brings together two institutions with deep Romanian market expertise and long-standing client relationships. The newly combined entity bolsters UniCredit's Romanian market position across corporate and retail banking, supporting the group's sustainable growth strategy. It now holds 11% of banking assets, 13% of loans, and 11% of customer deposits - a significant milestone demonstrating UniCredit's capacity for rapid, effective integration.

This increased scale allows the bank to offer enhanced support to individuals, SMEs, and local communities across Romania.

This strategic consolidation has created a stronger bank, better positioned for the future.

Alpha Bank Romania customers, now part of UniCredit, will benefit from an enhanced banking experience with an expanded range of products and services, a larger branch and ATM network, and leading banking technology. The new UniCredit Bank Romania operates approximately 300 branches strategically located for customer convenience, ensuring efficient access to various financial solutions. Customers can access a comprehensive network of 900 ATMs nationwide. The combined bank employs over 4,800 staff, including former Alpha Bank Romania colleagues.

Financial Strength and Shareholder Value

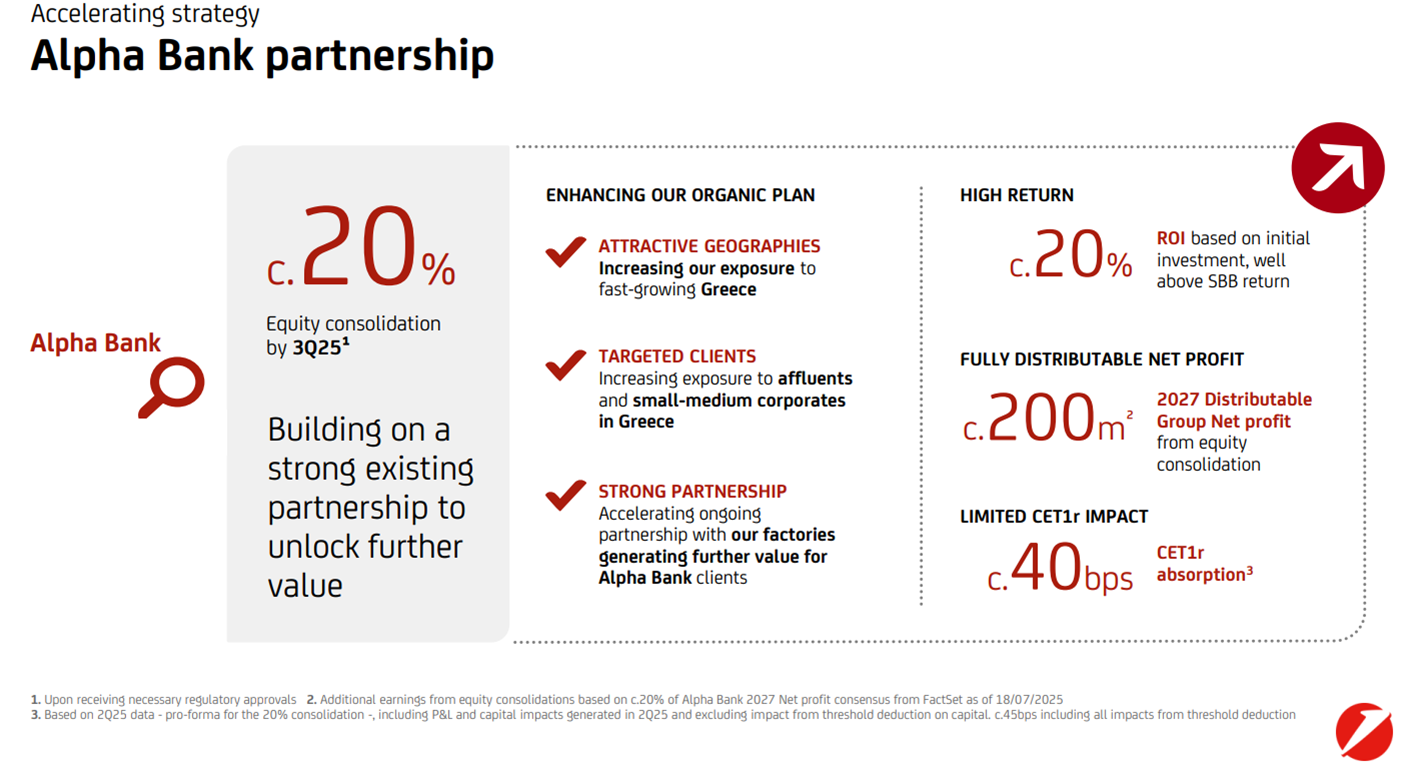

Our strategic approach delivers measurable value to our stakeholders. Through our partnership with Alpha Bank, we achieved a potential equity stake of approximately 26%, allowing for equity consolidation that better reflects the positive contribution of our strategic collaboration.

The partnership will continue to develop allowing us to capture more of the value we shall create together. This will boost the original numbers of our organic plan by increasing our exposure to an attractive and fast-growing economy, such as Greece, and targeted clients within.

Alpha will generate net profit of circa €244m in 2026 - and significantly grow from there - which UniCredit will return to its shareholders in line with its distribution policy.

Strategic Partnership in Greece Enhanced by Supportive Environment

UniCredit's increased equity stake in Alpha Bank has developed into a partnership that has exceeded expectations, benefiting from a supportive regulatory and government environment. The collaboration has been facilitated by constructive engagement from the Greek government throughout the process. As Europe's largest shareholder in Alpha Bank, UniCredit is now utilising its presence across 13 European countries to offer Greek companies broader access to European markets.

This collaboration enhances Greece's role as a key player in European banking integration, reflecting shared commitment to the country's economic progress and European financial cohesion.

Our commitment to UniCredit Unlocked

While we celebrate this partnership milestone, our management team remains focused on executing our UniCredit Unlocked strategy. This partnership exemplifies how strategic collaborations can enhance our ability to deliver superior sustainable profitable growth and distributions for our shareholders while serving our clients and communities with excellence.

Through thoughtful partnerships like this one with Alpha Bank, we continue to strengthen UniCredit's position as a leading European banking group committed to sustainable growth and stakeholder value creation.

Discover more on our Press Releases:

UniCredit and Alpha Services and Holdings announce merger in Romania and strategic partnership in Greece - UniCredit

(23 Oct 2023)

UniCredit Bank Romania merger with Alpha Bank Romania successfully completed - UniCredit

(18 Aug 2025)

UniCredit enters additional instruments relating to Alpha Bank S.A. shares for c. 5%, increasing its aggregate position to c. 26% - UniCredit

(28 Aug 2025)

A Strengthened Cross-Border Alliance: UniCredit and Alpha Bank Advance Joint Agenda

(26 Nov 2025)