In the first phase of UniCredit Unlocked we focused on releasing the trapped potential from within our organization.

Although the entire sector benefited from a more benign than expected macro, we have been able to leapfrog our peers, transforming into the leading pan-European Bank, outperforming across all financial KPIs. While laying future foundations, we delivered unrivaled shareholder value, distributing more than 26bn, significantly above our 2021-2024 target of 16bn.

In the second phase of UniCredit Unlocked we are shifting focus to further boosting our top line.

Our exciting story: the emergence of our true differential value

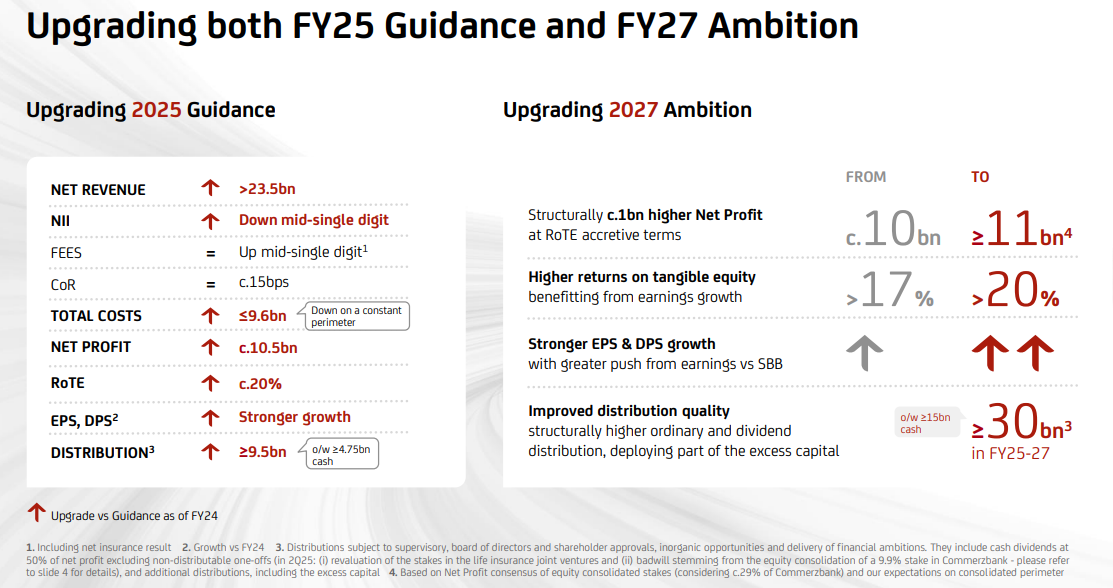

We aim to achieve ≥€11 billion of Net Profit by 2027, and to distribute ≥€30 billion over the next three years1: of which cash dividends at 50% of Net Profit. This is supported by a greater than 20% RoTE and the return of part of our excess capital2.

We continue to target strong EPS and DPS growth.

This will result in six years of improving performance and growth at an increasing margin over our cost of equity, which, coupled with an outsized yield, should also lead to a significant re-rating of our stock.

We deploy three levers to deliver sustainable quality financial growth:

- QUALITY GROWTH

Focusing on capital light growth and quality lending while maintaining discipline in origination.

- OPERATIONAL EXCELLENCE

Simplification and streamlining to target efficiencies and optimisation while continuing to invest in the future.

- CAPITAL EXCELLENCE

Considered capital allocation and active portfolio management to ensure sustainable, best-in-class organic capital generation.

We are excited about the challenge and determined to meet it.

1. Distributions subject to supervisory, board of directors and shareholder approvals, inorganic opportunities and delivery of financial ambitions. They include cash dividends at 50% of net profit excluding non-distributable one-offs (in 2Q25: (i) revaluation of the stakes in the life insurance joint ventures and (ii) badwill stemming from the equity consolidation of a 9.9% stake in Commerzbank - please refer to Market Presentation slide 4 for details), and additional distributions, including the excess capital.

2. vs target CET1r 12.5-13%.