With UniCredit Unlocked, we focused on releasing the trapped potential within our organization.

We have been able to leapfrog our peers, transforming into the leading pan-European Bank, outperforming across all financial KPIs.

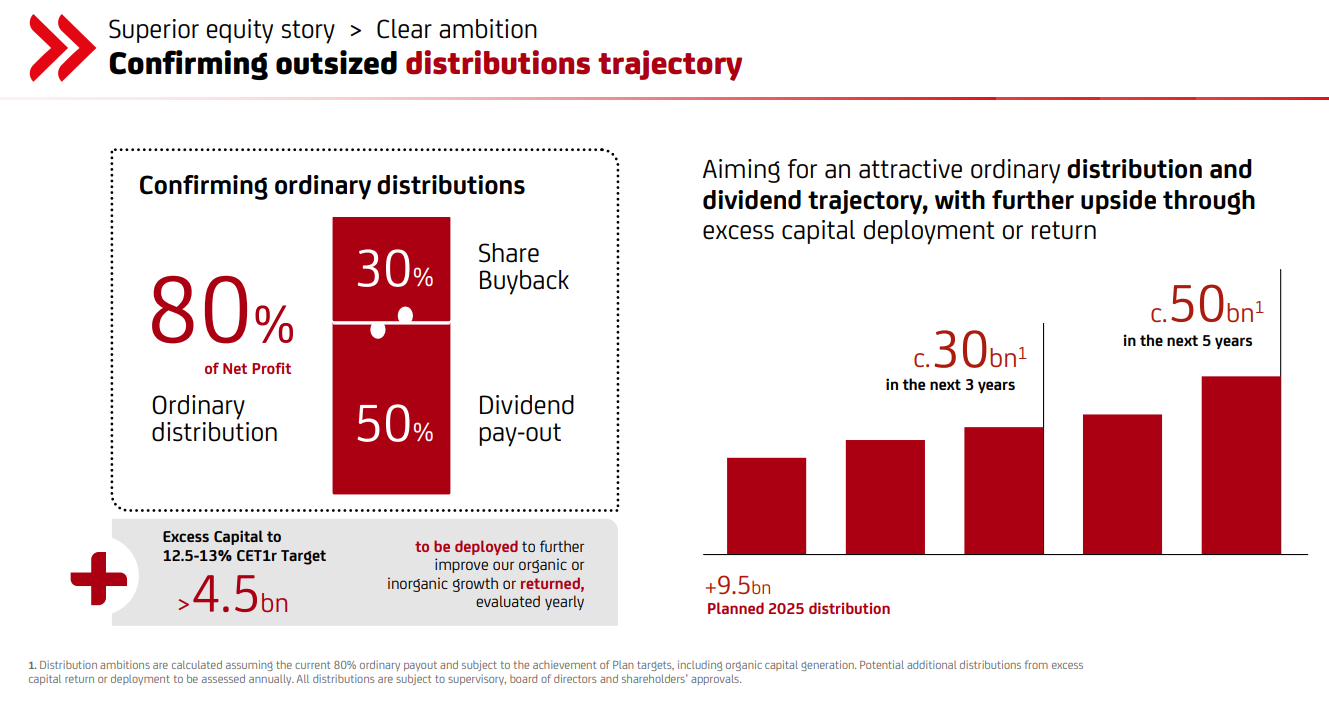

While laying future foundations, we delivered unrivaled shareholder value.

As we move from UniCredit Unlocked to UniCredit Unlimited, our focus shifts to accelerating top‑line quality growth, strengthening the resilience of our business model and redefining the sector's performance benchmark.

Our next chapter: UniCredit Unlimited

UniCredit Unlimited builds on the foundations of Unlocked to accelerate quality growth and reset sector efficiency, powered by technology, AI and our capital‑light engines. The strategy rests on two pillars: Unlimited Acceleration and Unlimited Transformation.

Unlimited Acceleration

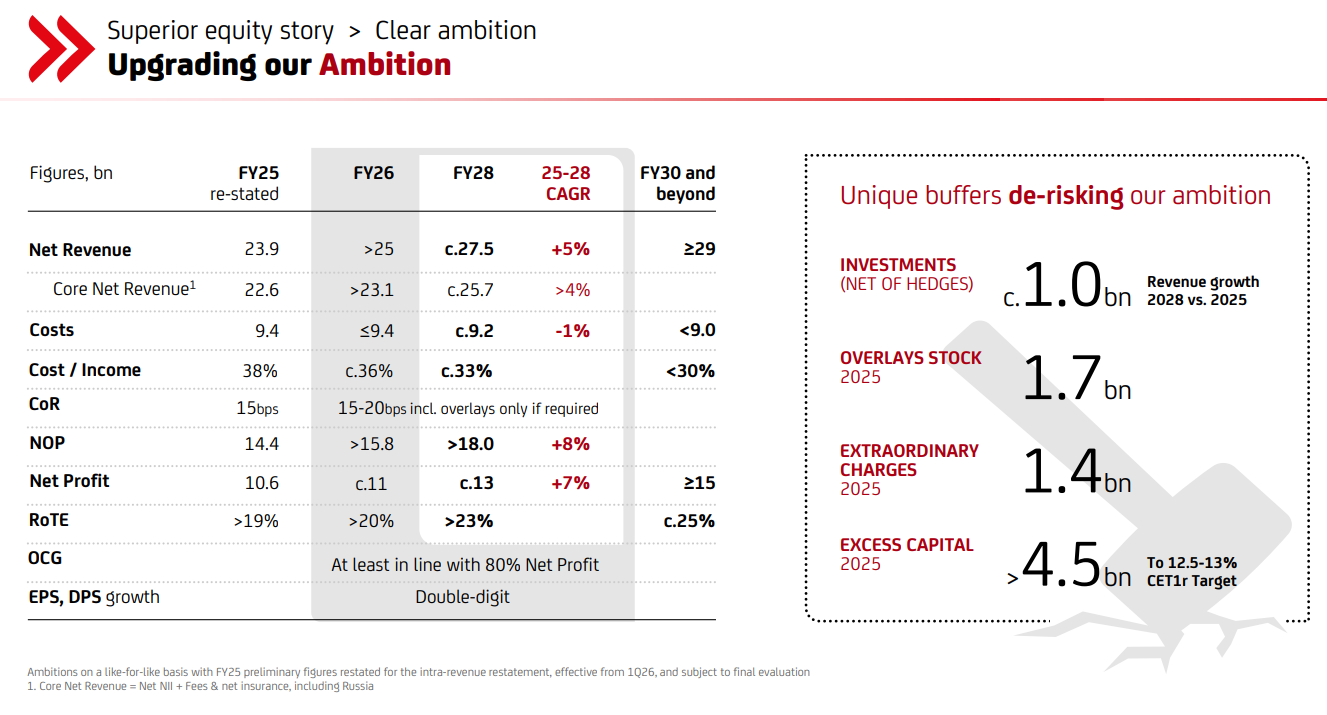

Focused on growing revenues profitably faster than peers, strengthening capital‑light engines and increasing the weight of Fees & Net Insurance toward ~38% of Net Revenue. It targets Net Revenue CAGR ~5% to ~€27.5bn by 2028, moving above €29bn by 2030.

Unlimited Transformation

Aims to reset the efficiency frontier by automating at scale, embedding AI across workflows and redesigning end‑to‑end processes. The goal is to reduce costs by ~1% per year to ~€9.2bn in 2028, trending below €9bn post‑2030.

Directional Ambition to 2030 and beyond

- Net Revenue ≥ €29bn

- Net Profit ≥ €15bn

- RoTE ~25%

- Cost/Income < 30%

Supported by strong buffers: >€4.5bn excess capital, €1.7bn overlays and a rising capital‑light mix.