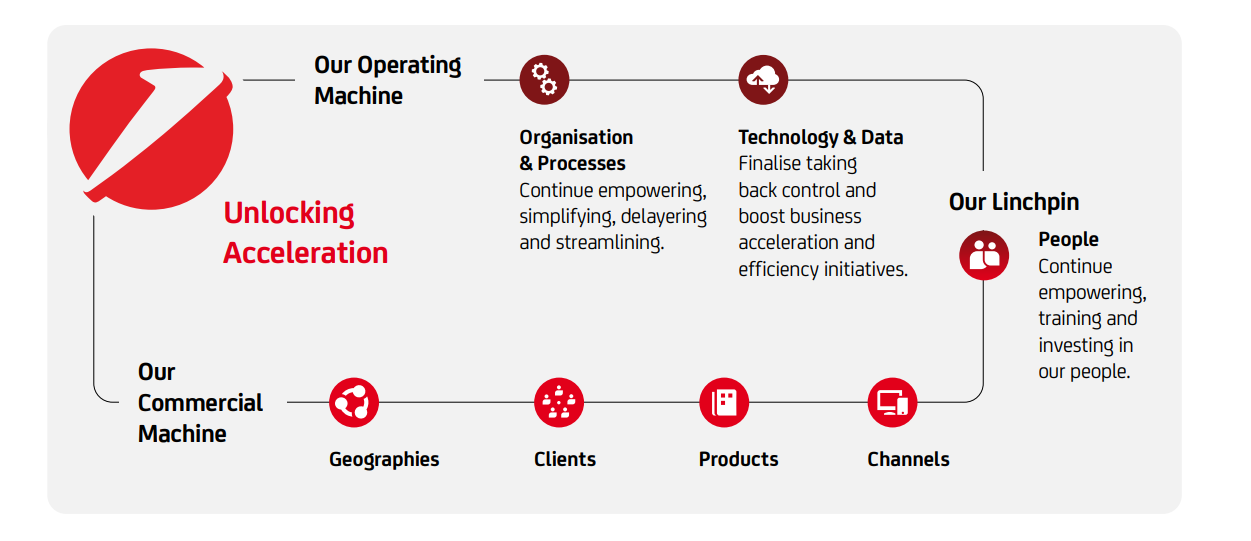

Unlocking Acceleration in 2025 and beyond

The first phase of UniCredit Unlocked focused on unlocking trapped potential - we have surpassed our own ambitions set at the end of 2021, resetting the bar higher each year. We have moved from laggard to leader in our sector and are now poised to enter the next chapter of growth. As we look ahead, we are evolving our Strategy to unlock Acceleration of our performance while completing our transformation. We will build on our structural advantages and accelerate our quality growth trajectory through clear alpha initiatives.

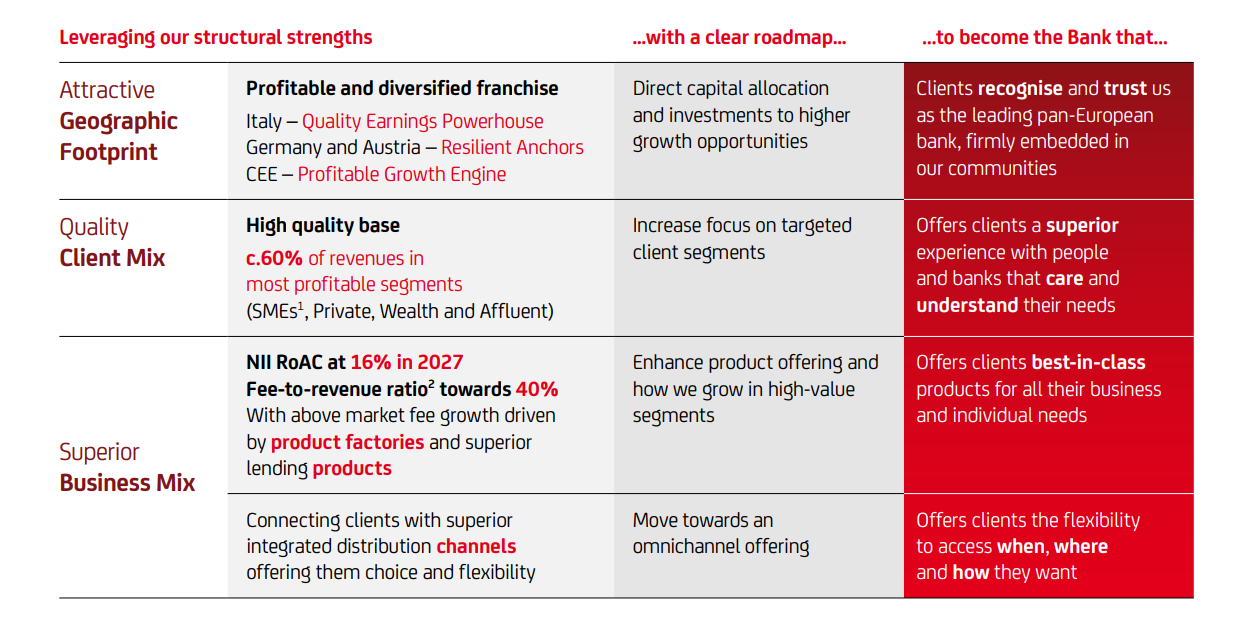

A new roadmap to navigate as the leading pan-European bank

We are optimally positioned to execute on this acceleration phase and solidify our position as a leading pan-European bank and a benchmark for the sector. We have a strong competitive edge thanks to our unique structural advantages and will build on these through alpha initiatives and investments in our business.

Leveraging our structural advantages

OUR CULTURE, PRINCIPLES AND VALUES:

- Our Group has created a new benchmark for banking, keeping our clients at the centre and unlocking the potential of our people.

- Our Culture is key to our success in unifying and inspiring our people, driving them to work as a team and achieve excellence in the right way. Our Culture network is fuelled by passion and enthusiasm, spreading positive cultural change throughout UniCredit. Collectively, we are building the Bank for Europe's future, as one team of people acting as true partners to our clients. A better bank, creating better outcomes: strongly grounded in the right Principles and Values; and delivering sustainable, quality growth and value.

OUR CLIENTS:

- Our 15 million clients are at the heart of everything we do. We build everything around their needs, providing choice and discretion through best-in-class products and innovative solutions.

- Our teams deliver exceptional service and personalised support, building strong relationships and consistently exceeding expectations. Through our service model, we leverage a range of distribution channels - physical and remote branches, call-centres, internet and mobile - accessible to our clients any time, anywhere.

OUR GEOGRAPHIES:

- UniCredit's profitable, diversified franchise is composed of 13 individual banks, across 4 regions, each with their own unique strengths and heritage.

- We continue to invest in all our regions enabling each of our banks to deliver quality profitable growth, consistently exceeding their standalone cost of equity.

- We are the only bank with structural capacity to bring Europe together as a federation of leading European banks.

OUR BUSINESS - Enhancing our product offering with three global product factories:

- While clients access our services through local banks, our comprehensive offering to meet their needs is created by our three global product factories - Corporate, Individual and Payment Solutions. Each of these factories delivers best-in-class solutions, developed internally or through our dynamic ecosystem of trusted partners.

DIGITAL UNLOCKED - Our updated Digital Strategy:

- Our determined efforts to accelerate transformation through simplification and centralisation have paid off. We are now taking back control of our technology and talent, building an operating model with end-to-end ownership of our core technology, products, and processes.

- In parallel, a strategic collaboration between UniCredit and Google will focus on technology modernization, migrating key applications to the cloud, AI acceleration and fostering new business opportunities.

AION BANK and VODENO:

- Through the combined capabilities of Aion Bank and Vodeno, UniCredit now has access to an innovative, scalable, and flexible cloud-based platform. They bring next-generation core banking technology, with a fully operational and scalable digital banking platform and a comprehensive range of products for high-value segments (e.g. affluent, SMEs).

- Our initial pilots consist, among others, of re-entering the Polish market, expanding in adjacent Western European countries and offering Embedded Finance solutions.

OUR FINANCIAL AMBITION: We have already shifted gear — from unlocking trapped potential to unlocking acceleration.

In Phase 2 of our strategy, we'll optimize our operating machine and further accelerate our commercial one. Despite industry headwinds, we are confident in delivering on our 2027 ambition of ≥11bn Net Profit at over 20% RoTE.

COMMITMENT TO SUSTAINABILITY:

- At UniCredit, we are committed to embedding Sustainability in everything we do.

- We lead by example, which is why ESG (Environmental, Social and Governance) is at the heart of our strategic framework and we have established clear principles to operate by.

>> Discover more about our vision and progress on our 2024 Annual Report microsite.

>> Read more about our latest Group Results and Market Presentations.

Magazine

Find out more by reading our articles: