The new approach to M&A for medium-sized companies.

DEALSYNC - THE MATCHING PLATFORM FOR M&A TRANSACTIONS

Signal your transaction interest, which we will securely record, analyse, and discuss with you to ensure we meet your strategic needs.

Using our intelligent matching process and the expertise of our M&A Bankers, we will work to provide you with potential

counterparties. Once you validate the list we will proceed to engage the selected counterparties.

After mutual interest is identified, we remain available to support you in facilitating an introduction and document exchange.

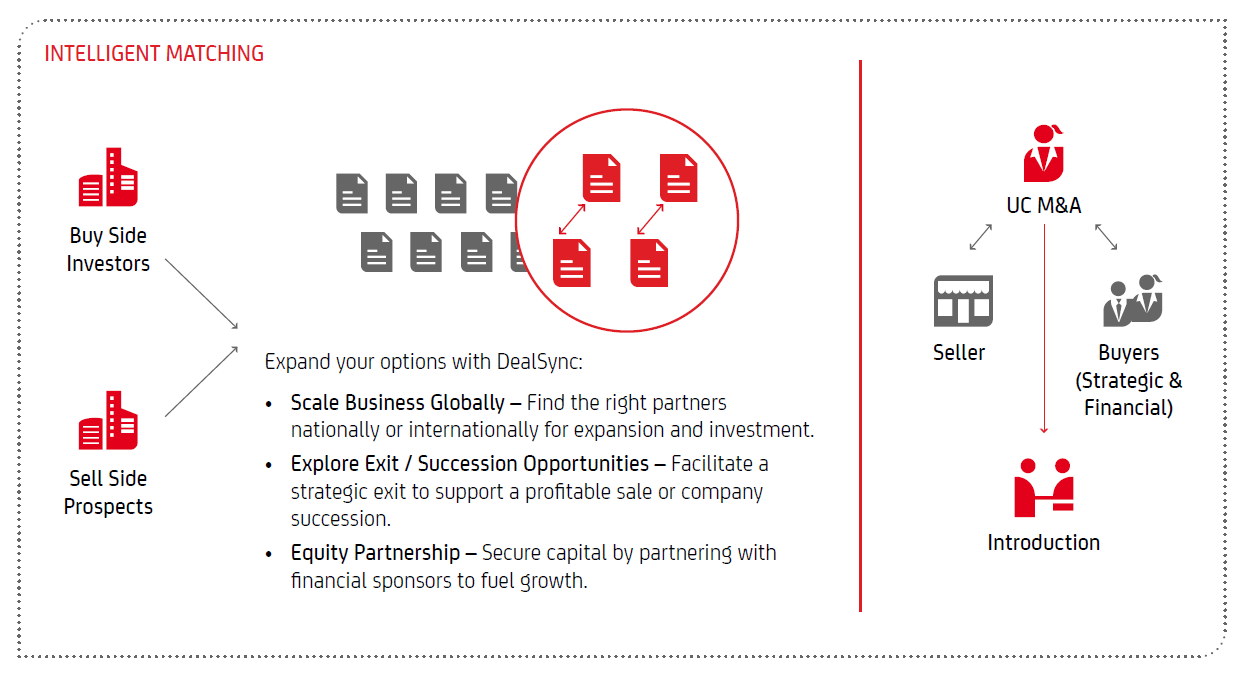

Our Intelligent Matching connects Buy Side Investors with Sell Side Prospects.

Expand your options with DealSync:

• Scale Business Globally - Find the right partners nationally or internationally for expansion and investment.

• Explore Exit / Succession Opportunities - Facilitate a strategic exit to support a profitable sale or company

succession.

• Equity Partnership - Secure capital by partnering with financial sponsors to fuel growth.

HOW DEALSYNC WORKS

- Mandate signing - Choose DealSync and let us find the investor or target company best suited to your needs.

- Intelligent matching - Our solution leverages advanced artificial intelligence tools and the experience of our M&A specialists to identify and select the best counterparties from our exclusive international network.

- Introduction - UniCredit facilitates the meeting between the parties and the exchange of documents.

- Selected Professionals - Thanks to qualified external professionals, we can provide integrated, rapid and customised services.

WHY CHOOSE DEALSYNC?

- CONFIDENTIAL AND FAST - Speed in selecting the best counterparty for the transaction, managing the company's data securely and confidentially.

- TRANSPARENCY - Clear and competitive pricing, tied to the success of the transaction, which makes it a premium service accessible to SMEs.

- NETWORK OF SPECIALISTS - A network of external specialists allows us to provide access to integrated and customised services - from strategic advisory to operational support for every phase of the business.

NEXT STEPS - HOW YOU CAN START USING DEALSYNC

If you are interested in the DealSync service model, please contact your account manager to discuss the details of your interest in an M&A transaction or contact us directly at dealsync@unicredit.eu.

Discover more on our local websites

Client Solutions is a division of UniCredit Group and consists of UniCredit S.p.A., UniCredit Bank GmbH, UniCredit Bank GmbH London Branch, UniCredit Bank GmbH Milan Branch and other members of UniCredit Group. UniCredit Group and its subsidiaries are subject to regulation by the European Central Bank. UniCredit S.p.A. is regulated by Banca d'Italia and supervised by the Commissione Nazionale per le Società e la Borsa (CONSOB). In addition, UniCredit Bank GmbH is regulated by the Federal Financial Supervisory Authority (BaFin), UniCredit Bank GmbH London Branch is authorised and regulated by the Financial Conduct Authority (FCA), and UniCredit Bank GmbH Milan Branch is also regulated by Banca d'Italia and supervised by the Commissione Nazionale per le Società e la Borsa (CONSOB).

This publication is intended for marketing purpose only and it is published by UniCredit Group. Under no circumstances may the information contained in the published material be construed as an offer, recommendation, invitation to offer or promotional message for the purchase, sale or subscription of financial products. This marketing communication is directed solely at investment professionals and constitutes a "non-retail communication" for the purposes of the relevant rules. This publication is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. In particular, this document and the information contained herein do not constitute an offer of securities in the United States and are not intended for publication or distribution to persons in the United States or in the territory of the United States (as provided for in Regulation S of the United States Securities Act of 1933, as subsequently amended and supplemented). Upon receipt of this publication, the recipient agrees that it does not constitute investment, legal, tax or accounting advice by UniCredit and that UniCredit will not have any fiduciary or other relationship with the recipient that may arise from a commitment to provide such advice and the recipient shall act independently of such activities. This communication is addressed exclusively to professional clients within the meaning of MIFID II.

UniCredit Group reserves the right to update / modify the data and information contained in this publication at any time without prior notice. The contents of the publication - including any data, news, information, images, graphics, designs, trademarks (including DealSync), and domain names - are the property of UniCredit Group, unless otherwise indicated, and are protected by copyright and industrial property laws. No license or right of use is granted, and therefore reproduction of the contents, in whole or in part, on any medium, copying, publishing, or commercial use is not permitted without prior written authorization from UniCredit Group, except for the possibility of making copies for personal use only.