At home throughout Europe, UniCredit is the partner of choice for our clients' increasingly sophisticated demands in financing, advisory, investments and protection. We serve over 15 million clients in a cohesive manner worldwide. We do this through a harmonised service model, simplifying our processes and establishing a common organisational structure across our business.

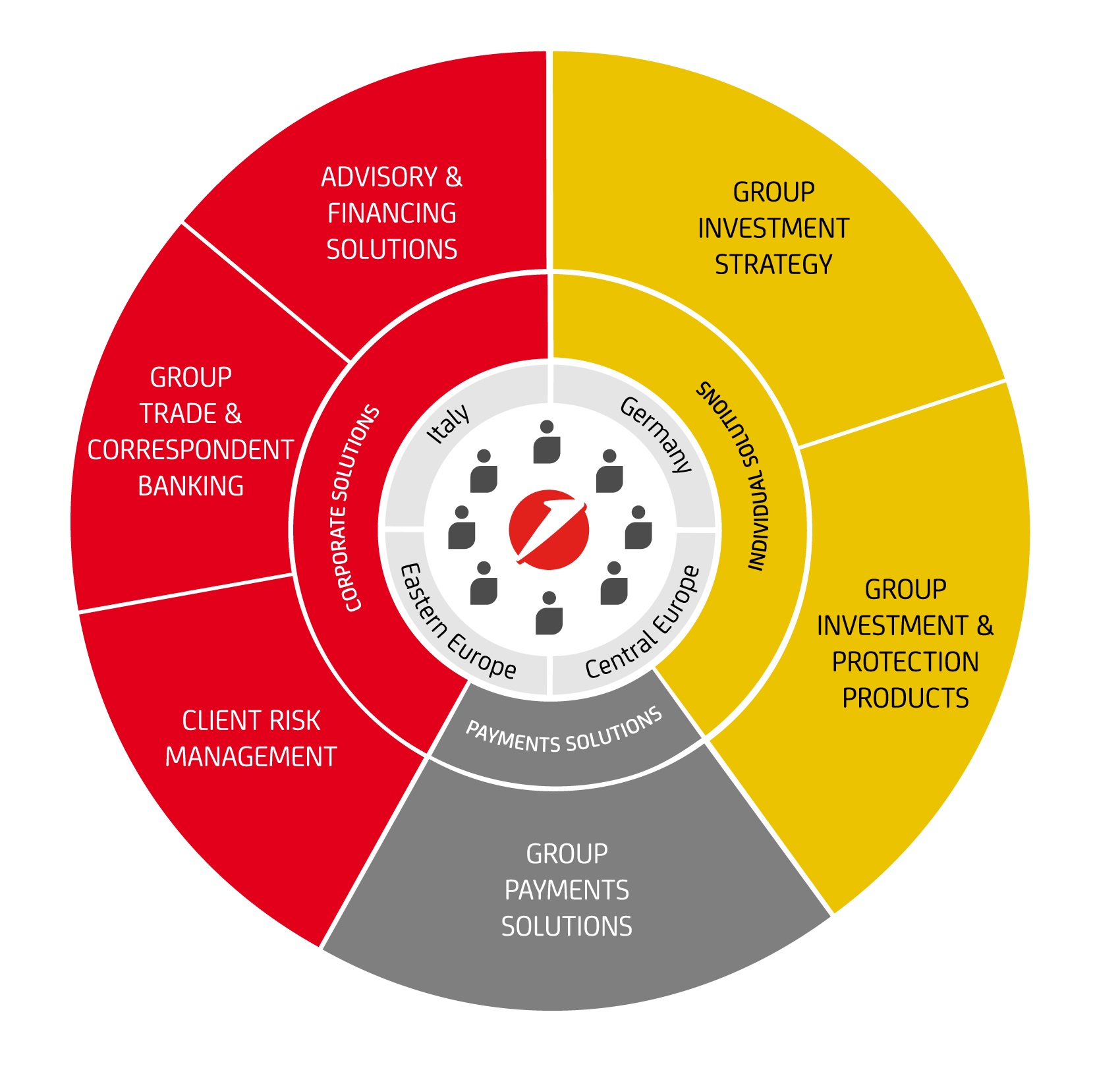

Our division Client Solutions serves all our regions and is comprised of three excellent product factories: Corporate Solutions delivers tailored solutions in advisory, financing, risk management, trade and working capital for our corporate clients; Individual Solutions ensures a rich offering of investment and protection products for individuals; whilst Group Payments Solutions supports corporates, financial institutions, and individual customers in all their payments and liquidity management needs.

We have given these factories the momentum and investment they need to be truly best-in-class - all whilst enhancing our strategic dialogue and keeping the client at the centre of our focus.

This allows us to be closer to our clients and leverage the scale of the entire Group to develop a comprehensive range of content-led products and services across each of our markets.

Our purpose is to empower communities to progress, whilst unlocking the potential of our clients and our people.

CORPORATE SOLUTIONS:

- Advisory & Financing Solutions

- Group Trade & Correspondent Banking

- Client Risk Management

INDIVIDUAL SOLUTIONS:

- Group Investment Strategy

- Group Investment & Protection Products

PAYMENTS SOLUTIONS:

- Group Payments Solutions

Corporate Solutions

Corporate Solutions facilitates access to value-added services for our corporate clients through three specific product lines: Group Trade & Correspondent Banking, Client Risk Management, Advisory & Financing Solutions.

Our product expertise is delivered effectively and consistently with local coverage, which is deeply rooted in our countries.

At the same time, our cross-border positioning allows us to effectively support clients in their trade and growth ambitions.

With International Network locations in Europe, Asia and the Americas, we also facilitate our clients' cross-border business into Europe.

Individual Solutions

Individual Solutions is structured along two pillars and ensures an attractive product offering for our retail, wealth management and private banking clients across countries.

Group Investment Strategy is responsible for defining a unique Group investment strategy for all client segments, managing portfolios under mandate and supporting related client activity.

Group Investment & Protection Products oversees the development and management of our investment product offering across all countries and client segments, managing relationships with Group partners as well as our internal asset management factories.

Payments

Solutions

Group Payments Solutions supports corporates, financial institutions and individuals with innovative and best-in-class Cash Management, Payments, Acquiring and Issuing solutions.

As a leading bank for Payments and Cash Management in Europe, we help clients in their transactional business, efficiently managing domestic and cross-border payments in more than 100 foreign currencies.

Digitalisation remains a key enabler for our service, as evidenced by our UC PayFX service, and allows our clients to streamline operations, optimize costs, and mitigate operational risks.

In Payments, our ambition is to be every European client's first choice.

Solutions for

Portals

Our multiple Portals keep our clients informed on key developments and trends in the major financial markets.

One platform for all major financial markets

Our onemarkets investment platform provides simple access to all major financial markets. Investors can choose from a wide range of investment and leverage products or create highly tailored solutions, benefitting from the expert guidance of our experienced professional team.

Discover more about onemarkets Fund

Expertly structured investment funds

Structured Invest delivers white-label investment funds including mutual funds (UCITS), specialised investment funds in Luxembourg (SIFs) and exchange-traded-funds (ETFs) with notable expertise in SICAVs (Société d'Investissement à Capitale Variable) and FCPs (Fonds Communs de Placement).

Our Cross Asset Derivative team provides investment strategies and quantitative structuring which enable highly tailored fee structures and distribution channels. Together with our asset management and investment banking skills, we offer our clients unique, value-added services.

UC Hedge is the state-of-the-art end-to-end solution for FX risk management

We offer a Treasury Management as a Service (TMaaS) to alleviate clients' operational needs, enabling them to have a transparent insight to their net exposure, simulate hedging strategies and execute these automatically with us.

Key features

- Risk Transparency: Thanks to an easy interface, clients will be able to organise and aggregate in one place all FX risk elements coming from different sources

- Risk Analysis: Clients will be able to analyse the FX risk against their hedging policy and calibrate it to meet desired risk tolerance levels and protect their EBITDA

- Risk Hedging: UC Hedge enables the treasurer to identify, simulate and execute hedging instruments directly through the application and in full cost transparency, in order to realign the net exposure to your hedging policy

Online FX trading from UniCredit

UCTrader is our dedicated online FX trading platform, giving direct access to live pricing and rapid trade execution for spot, forward and swap rates. The platform offers comprehensive pricing, with over 50 currencies and 140 currency pairs, priced at 0.1 pip intervals. Features such as pre-defined product groups and simple functions for adding, deleting and editing currency pairs as well as customisable desktops ensure a simple, flexible user experience.

For more details on using UCTrader, please refer to our guide

Key Features

Comprehensive pricing:

- Over 50 currencies and 140 currency pairs

- 0.1 pip price intervals

- Pre-defined product groups

- Add, delete and edit trading pairs

Fast, simple trading:

- One-click trading up to a limit

- Unlimited trade size via RFS

- Quote and deal in as few as 3 clicks

- Rapid trade execution for spot, forward and swap rate

Customisable desktop:

- Create personalised layouts

- Save, edit and load different layouts

- Drag-and-drop functionality

- Add, delete and move panels

Search, filter and print:

- Search for active trades

- Filter by account

- Printable blotters with daily activity listings

Empowering SMEs with a modern M&A strategy

99% of all European businesses are SMEs. Yet M&A and Capital Market services are designed for the 1%. Historically, small deal sizes with limited success rate prevent banks from providing a profitable M&A service for SMEs. DealSync by UniCredit is our answer to this challenge.

DealSync is our AI-powered platform purpose-built to offer SMEs seamless access to M&A and Capital Markets - fast, confidential, secure and cross-border.

With DealSync, SMEs can now pursue strategic growth opportunities or plan their exit strategies with the same resources and support traditionally reserved only for large corporates.

More than just a technology solution, DealSync builds on UniCredit's long-standing M&A expertise, deep client relationships, and trusted advisory experience. It supports SMEs by facilitating and accelerating deal-making, leveraging the bank's extensive international network.

Discover more about DealSync by UniCredit