Should we fear central banks’ tapering?

Monday 15 November 2021

To answer this question, we should start by defining “tapering” as the gradual reduction of liquidity injections, determined by bond purchases, by the central bank in the financial system.

This typically happens in a period of expansionary monetary policy, when the central bank signals it wants to take a less dovish stance that could end, eventually, in neutral monetary policy initially – before becoming restrictive policy (this happens when the central bank drains liquidity from the system or hikes reference short-term interest rates). So, “tapering” per se is still a supportive monetary policy tool, although it does signal that monetary conditions could be less supportive in the future. Anyway, and much more importantly, to better understand the potential negative impact of tapering are the timing, size and starting conditions.

When it comes to timing, it is a shared opinion that in the US, tapering is likely to start in the next month. Many economists believe that the Fed should have started to taper months ago, when it clearly emerged that the global economic recovery was gaining traction. Recently, the Fed President gave clear guidance that labor market conditions should improve before starting the process. On the other side of the ocean, the ECB President affirmed that the Pandemic Emergency Purchase Programme (PEPP) will last at least until March 2022, and even most hawkish ECB members have always supported the necessity, in case of a scale down, to act very gradually. So, the impression is that central bankers have preferred to wait some more months than to risk hampering the recovery in a complex economic environment.

When it comes to the size, the Fed is currently injecting about USD120 billion per month, and the ECB EUR80 billion per month. A probable size of reduction for both is around 15 billion per month, in their respective currencies. So from the starting month, we will still have around six to eight months of a net positive increase. We should also remember that for ECB, the PEPP is an additional support programme, on top of the Asset Purchasing Programme (APP) launched in 2015 and reactivated in 2020, which is currently operating under the radar with EUR20 billion purchases per month. Once the net positive contribution will be zero, central banks will start reinvesting bonds maturing to maintain asset stability. This will be the neutrality phase that could last an additional six to eight months. The ECB has already stated that assets reinvestment will last at least until March 2023.

Central Banks prepare for exit

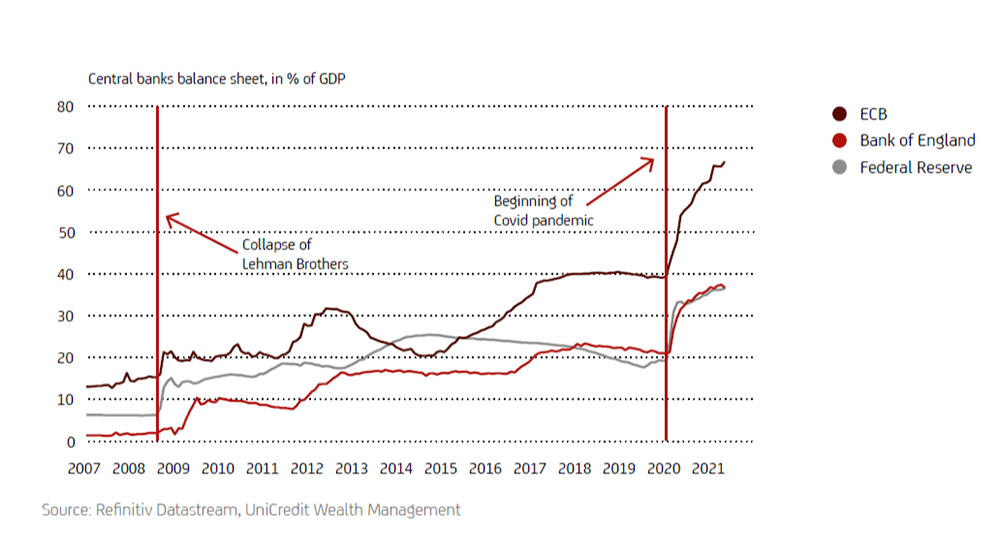

Last, but not least, we must consider current monetary conditions. From a historical point of view, the Fed and ECB currently have their highest level of assets on their balance sheet as a percentage of GDP: 40% the first, 60% the second (the Bank of Japan and Swiss National are at 120% and 140%, respectively). And central banks in the western world have been, since the pandemic broke out in 2020, the main buyers in government bond secondary markets. Their role in the economy and financial markets has never been so relevant, and current monetary conditions are, by several indicators, the most favourable in decades signaling therefore abundant liquidity. Just to mention some, current real yields on 10-year US Treasuries TIPS (Treasury Inflation Linked Notes) are at -1% and the same tenor inflation linked German Bunds real yields are even lower at -2%, record lows. Negative real yields are powerful stimuli for fixed investments and prospective growth.

In conclusion, yes, tapering is about to start, but gradually in terms of timing and size – and against an extra loose monetary policy environment. Economies and financial markets will be able to absorb it, and maintain potential growth and a positive outlook.

Read more - UniCredit Wealth Management Monthly Outlook - November 2021 – Keep Calm and Carry On-

https://www.cordusio.it/wp-content/uploads/2021/11/02_DEF_ENG_MO_NOV_21_MID.pdf