UniCredit obtains financial resources from external providers by issuing securities.

The funds raised are used to support our clients' business and the bank's operations, for the medium-long term.

Our funding profile is well-diversified and centrally coordinated.

Information about these securities is available on this page.

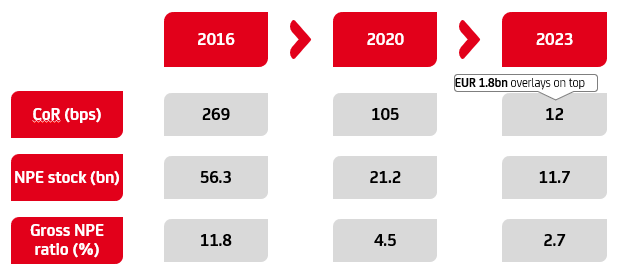

NPE down by c.45bn thanks to proactive and disciplined risk management

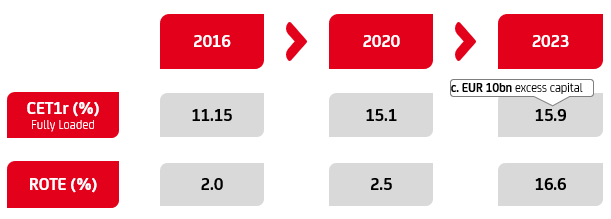

Significantly strengthened capital

Fixed income & ESG presentations

Credit ratings

Funding programmes and prospectuses