UniCredit is committed to playing its part in the Net Zero transition and is actively working to reduce its own direct and indirect environmental impact. UniCredit is targeting Net Zero on own emissions by 2030 and on financed emissions for relevant most carbon intensive sectors by 2050.

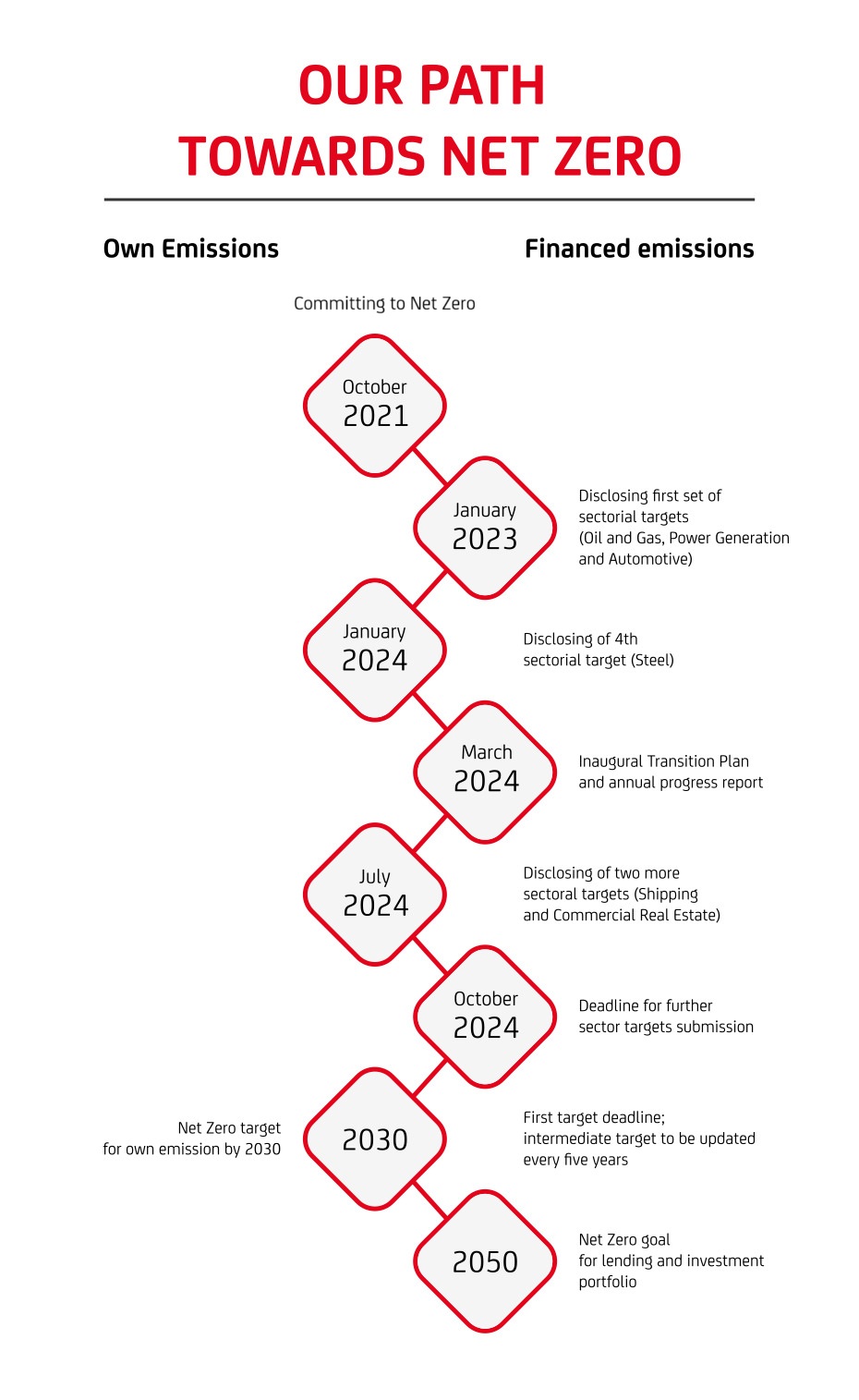

OUR PATH TOWARDS NET ZERO

Own Emissions

- October 2021: UniCredit commits to Net Zero

- 2030: Net Zero target for own emissions by 2030

Financed Emissions

- October 2021: UniCredit commits to Net Zero

- January 2023: Disclosing first set of sectoral targets (Oil and Gas, Power Generation and Automotive)

- January 2024: Disclosing of 4th sectoral target (Steel)

- March 2024: Inaugural Transition Plan and annual progress report

- July 2024: Disclosing of two more sectoral targets (Shipping and Commercial Real Estate)

- October 2024: Deadline for further sector targets submission

- 2030: First targets deadline; intermediate targets to be updated every five years

- 2050: Net Zero goal for lending and investment portfolio

FINANCED EMISSIONS

UniCredit Group disclosed its 2030 intermediate targets on Oil&Gas, Power Generation, Automotive, Steel, Shipping and Commercial Real Estate in 2023 and 2024. On Coal, UniCredit Group has already defined a phase out policy by 2028.

For Residential Real Estate, the bank identified a 2022 baseline to track its progress over time while a declaration of non-materiality had been done for Aluminum, Aviation, and Cement. For Agriculture, future developments of European and local policy frameworks and the evolution of recognised methodologies and data availability will be monitored, as prerequisites for a proper target definition.

In addition, UniCredit published its Net Zero Transition Plan and is monitoring progress on disclosed sectoral targets. Our transition plan illustrates how we are turning our commitments into actions, making our targets operational, and ensuring all relevant functions of the Bank can contribute.

How do we set our targets?

Net Zero targets have been defined in line with Net Zero banking guidelines and main methodologies available on the market (e.g. PCAF, Sustainable Steel Principles). Both clients' direct emissions (scope 1) and indirect emissions (scope 2 and 3) have been analyzed. The decision to ultimately include them in baseline and target was based on the materiality of emissions, data and methodology availability.

To define intermediate 2030 target, the Bank referred to Net Zero 1.5° scenarios (i.e., IEA NZ 2050 for Oil & Gas, Power Generation, Automotive, Steel, Shipping, and CRREM v.2.01 for Commercial Real Estate).

| Sector | Scope | Value Chain |

Metric | Scenario Benchmark | Baseline Year | Baseline Value | 2022 YE Progress | 2023 YE Progres | 2030 Target |

|---|---|---|---|---|---|---|---|---|---|

Oil & Gas |

Scope 3, Category 11 | Upstream, Midstream, Downstream | Absolute Financed Emissions |

IEA NZ 2050 (World) | 2021 | 21.4MtCO2e | -10% vs. baseline (19.3MtCO2e) | -50% vs. baseline (10.2 MtCO2e | -29% vs. baseline (15.2MtCO2e) |

Power Generation |

Scope 1 | Power Generation | Emissions Intensity |

IEA NZ 2050 (Europe) | 2021 | 208 gCO2e/kWh | 152 gCO2e/kWh | 107 gCO2e/kWh | 111 gCO2e/kWh |

Automotive |

Scope 3, Category 11, Tank-to-wheel | Automotive manufacturers (Light-duty Vehicles) | Emissions Intensity |

IEA NZ 2050 (World) | 2021 | 161 gCO2/vKm | 165 gCO2/vKm | 116 gCO2/vKm | 95 gCO2/vKm |

| Steel | Fixed System Boundary - Scope 1, 2 and 3 (Category 1 and 10) | Crude Steel Makers |

Emissions Intensity Alignment Score |

IEA NZ 2050 (World) | 2022 2022 |

1.45 tCO2/tSteel -0.69 |

- - |

1.50 tCO2/tSteel

-0.17 |

1.11 tCO2/tSteel |

Shipping |

Scope 1 and 3 (Category 3) – WTW | Shipping Operators | Emissions |

IEA Net Zero 2050 (World) | 2022 | Passenger: 14.1 gCO2e/GT-nm

Merchant: 9.5 gCO2e/dwt-nm |

- | Passenger: 14 gCO2e/GT-nm

Merchant: 9.3 gCO2e/dwt-nm |

-30% vs baseline |

Commercial Real Estate |

Operational Emissions | RE operators - building ownsers (asset financing) | Emissions Intensity | CRREM v.2.01 | 2022 | 44.2 kgCO2e/m2 | - | 43.4 kgCO2e/m2 | -44%/-55% vs baseline |

Residential Real Estate |

Operational Emissions | Homeowners (Mortgages) | Emissions Intensity | - | 2022 | 36.3 kgCO2e/m2 | - | 35.8 kgCO2e/m2 | - |

Steel is the world's most important engineering and construction material, used in almost every aspect of our lives - from the cars we drive and the buildings we work in, to the homes in which we live and the kitchen appliances we use every day. But steel is also responsible for over 7% of global CO 2 emissions and the industry is considered as one of the hard-to-abate sectors. The greenest steel globally will be produced by H2 Green Steel in Sweden, from 2026 onwards. This greenfield project will become the first hydrogen-based flat steel mill and is designed to abate up to 95% of CO 2 emissions in comparison with traditional blast furnace steel making. UniCredit has been involved early in the financing process as a 'Pathfinder Bank' to coordinate the lenders' technical and environmental and social due diligence. As one of the leading lenders, we are also engaged as Bookrunner and Mandated Lead Arranger.

In May 2023, Mercedes-Benz Group brought a dual-tranche €2bn green bond to the market - the first EUR green bond issued since April 2021. UniCredit acted as Bookrunner, Technical Lead, Billing and Delivery Manager of the deal.

OWN EMISSIONS

UniCredit has been making tangible and consistent progress to cut its own greenhouse gas emissions over the last years.

In 2024, our Group's own greenhouse gas emissions from its own activities amounted to: 24,412 tCO2e (Scope 1); 16,702 tCO2e (Scope 2 market-based).

Our Group's goal is to achieve Net Zero on own emissions (Scope 1 and 2 market-based) by 2030.

Following the introduction of the EU Corporate Sustainability Reporting Directive (CSRD) and relative Sustainability Statement, we have revised the base year of our Net Zero own emissions target to 2024 (previously 2021).

Our achievements to date include 91% of the electricity procured by our Group in 2024 was from renewable energy sources.

Reducing our direct environmental impacts across Europe

We have established well-defined objectives to contain our environmental footprint, in particular the reduction of GHG emissions arising from our own operations. This includes reducing our energy consumption mainly through space optimisation measures, procuring electricity from renewable sources, improving the energy efficiency of our premises and data centres, and transforming our heating systems from fossil fuels to more sustainable sources (heating pumps or district heating).

We were the first bank in Italy to close a corporate PPA (Power Purchase Agreement) to meet the energy demand of our data centres located in Verona, Italy. This agreement strengthens UniCredit's group-wide Green Energy Procurement strategy, serving as a best practice across our geographies.

In addition to renewable energy sourcing, we are also committed to improving space and energy efficiency in our buildings. In 2023, we introduced a new Smart Office Workplace Policy to define space efficiency KPIs and provide guidelines on energy efficiency measures and improv the quality of the built office environment with a focus on hybrid solutions, health, well-being and sustainability.

Moreover, we have consolidated our efforts in applying smart energy control systems, improved thermal insulation, adapted temperature settings for heating and cooling, and improved the algorithms that manage Heating, Ventilation, and Air Conditioning (HVAC) and lighting controls, optimising both energy consumption and workplace comfort.

UniCredit has signed a partnership with CVA for the supply of electricity produced from renewable sources. The collaboration with CVA, a green power company based in the Aosta Valley, will result in the construction of three new solar plants in Piedmont, Lombardy and Sicily.

The new solar plants with a total capacity of 25MW will be operational in 2024, providing 35GWh per year to supply the energy demand of UniCredit data centres in Verona, covering around 20% of the bank's total electricity consumption in Italy. CVA will sell green energy to UniCredit at a set price, optimising the risk profile of the investment in its assets. This is the first time that a financial institution has committed to a corporate PPA (Power Purchase Agreement) in Italy.

UniCredit is the first bank in Europe to obtain the Global Real Estate Sustainability Benchmark (GRESB) scoring on its corporate real estate portfolio. The total portfolio analysed based on GRESB's sustainability criteria included properties owned by the Group, with an approximate value of €5bn, located across Italy, Germany and Central and Eastern Europe.

The initiative also showcases UniCredit as a frontrunner on ESG reporting for property management. The GRESB scores will be consolidated over time through continued monitoring of the ESG performance of the Group's properties and the related management processes, along with a constant comparison of these against the highest market standards.

In Germany, we have recently adopted a new car policy with the aim of achieving the Net Zero goal on our own emissions by 2030.

We expect a further reduction in company cars, from over 3,000 in 2017 to slightly over 1,000 by 2023, with a fleet comprising only battery electric vehicles.

Charging on bank premises will be favoured by the implementation of car electricity infrastructure which we expect to be complete by 2025.

We are part of the Principles for Responsible Banking (PRB) Biodiversity community, a capacity-building programme aimed at fostering awareness of the importance of biodiversity and its impact on ecosystem services, as well as recognising biodiversity loss as a risk to both businesses and the financial sector.

Moreover, this year, within the UNEP FI Biodiversity working group, we have contributed - alongside 34 international banks, but the only one from Italy - to the publication of the Principles for Responsible Banking "Nature Guidance for Banks". This aims to help the banking industry align with the Kunming-Montreal Global Biodiversity Framework (GBF) and address nature and biodiversity loss.

UniCredit Bulbank has signed a new three-year contract to accelerate its renewable energy use and significantly reduce its carbon footprint.

It will now purchase electricity from a photovoltaic power plant, so around 75% of the bank's total energy consumption will be from green energy generation.

Bulbank will purchase green energy monthly, with an annual supply of 7,000 MWh. The origin of the energy purchased will be guaranteed in the form of certificates from the Sustainable Energy Development Agency (AUER).