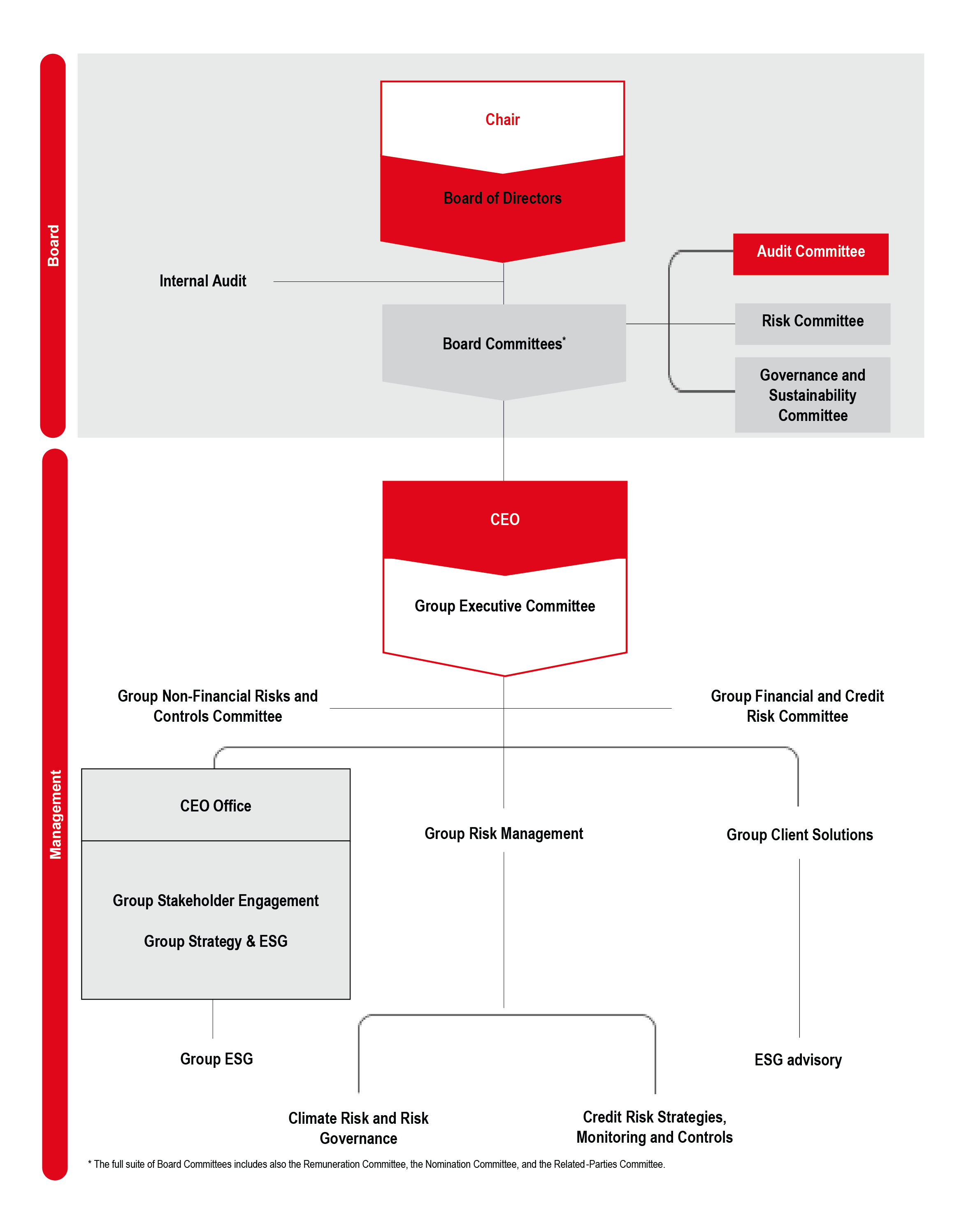

UniCredit's corporate governance system promotes clarity and accountability, while constantly evolving to ensure long-term sustainable value

The UniCredit Board of Directors (i) defines the overall strategy of the Bank and the Group, of which the Group's ESG Strategy and its associated KPIs are an important pillar, and oversees its implementation over time, and (ii) establishes policies to govern the risks to which the Group may be exposed, risk targets and tolerance thresholds, as well as reviewing them periodically.

The Governance and Sustainability Committee provides advice and support to the Board on matters related to corporate governance and in fulfilling its responsibilities, while pursuing sustainable success as an integral component of the Group's business strategy and long-term performance.

The Group Executive Committee (GEC) is the Group's most senior executive committee and is chaired by the CEO. Its mission includes establishing the banks' comprehensive ESG strategy, including the formulation of initiatives related to ESG topics, setting targets and guidelines at the Group level.

Click here for more information on the overall Governance of UniCredit Group