Investors

We are committed to disclosing UniCredit's latest financial information to investors, financial analysts and rating agencies in a transparent, timely and proactive way.

4Q25 & FY25 Group Results Presentation

"We need to streamline our business so that we can operate faster, with greater clarity, and deliver successfully for all stakeholders. This is an ambition that many aspire to but few really achieve. I believe we will be one of the few exceptions”

Andrea Orcel

Chief Executive Officer of UniCredit S.p.A.

4Q25 & FY25 - Group Results - Infographic (ENG)

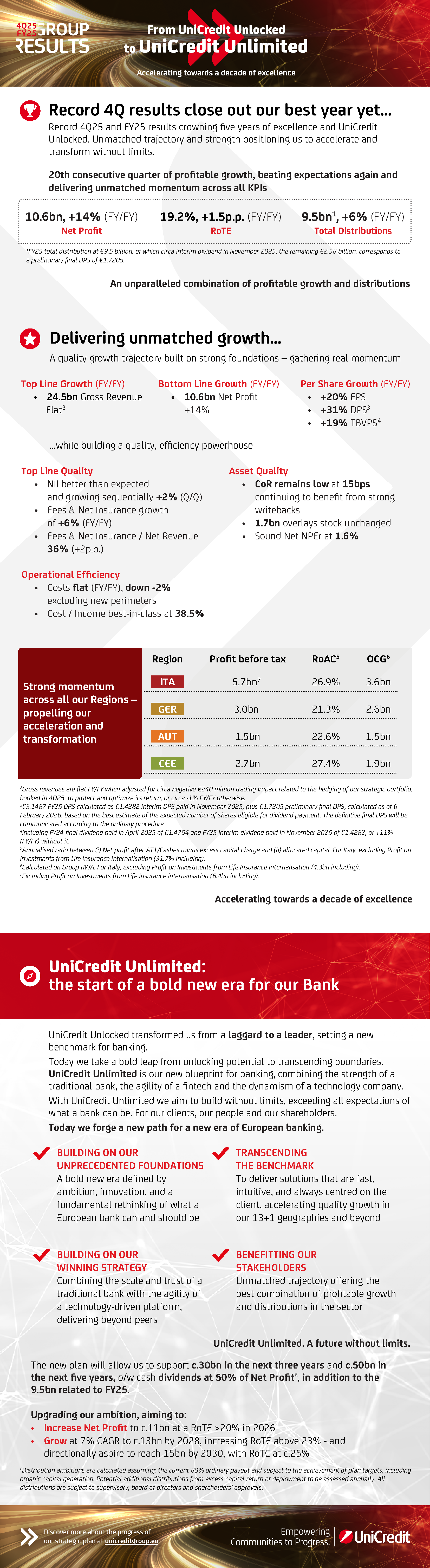

Main Title: 4Q25 & FY25 Group Results

Subtitle: From UniCredit Unlocked to UniCredit Unlimited - Accelerating towards a decade of excellence

Section 1

Title 1: Record 4Q results close out our best year yet...

Record 4Q25 and FY25 results crowning five years of excellence and UniCredit Unlocked. Unmatched trajectory and strength positioning us to accelerate and transform without limits.

Section 1.1

Text:

20th consecutive quarter of profitable growth, beating expectations again and delivering unmatched momentum across all KPIs

10.6 bn, +14% FY/FY

Net Profit

19.2%, +1.5p.p. FY/FY

RoTE

9.5bn[1], +6% FY/FY

Total Distributions

An unparalleled combination of profitable growth and distributions

Title 2: Delivering unmatched growth...

Section 1.2

Text: A quality growth trajectory built on strong foundations - gathering real momentum

● Top Line Growth

○ 24.5bn Gross Revenue

Flat[2] (FY/FY)

● Bottom Line Growth

○ 10.6bn Net Profit

+14% (FY/FY)

● Per Share Growth (FY/FY)

○ +20% EPS

○ +31% DPS[3]

○ +19% TBVPS[4]

Text: ...while building a quality, efficiency powerhouse

● Top Line Quality

○ NII better than expected and growing sequentially +2% (Q/Q)

○ Fees & Net Insurance growth of +6% (FY/FY)

○ Fees & Net Insurance / Net Revenue 36% (+2p.p.)

● Asset Quality

○ CoR remains low at 15bps continuing to benefit from strong writebacks

○ 1.7bn overlays stock unchanged

○ Sound Net NPEr at 1.6%

● Operational Efficiency

○ Costs flat (FY/FY), down -2% excluding new perimeters

○ Cost / Income best-in-class at 38.5%

Section 1.3

Strong momentum across all our Regions - propelling our acceleration and transformation

Table:

Region |

Profit before tax |

RoAC[5] |

OCG[6] |

ITA |

5.7 bn[7] |

26.9% |

3.6bn |

GER |

3.0 bn |

21.3% |

2.6bn |

AUT |

1.5 bn |

22.6% |

1.5bn |

CEE |

2.7 bn |

27.4% |

1.9bn |

Accelerating towards a decade of excellence

Section 2

Title: UniCredit Unlimited: the start of a bold new era for our Bank

Section 2.1

Text

UniCredit Unlocked transformed us from a laggard to a leader, setting a new benchmark for banking.

Today we take a bold leap from unlocking potential to transcending boundaries. UniCredit Unlimited is our new blueprint for banking, combining the strength of a traditional bank, the agility of a fintech and the dynamism of a technology company.

With UniCredit Unlimited we aim to build without limits, exceeding all expectations of what a bank can be. For our clients, our people and our shareholders.

Today we forge a new path for a new era of European banking.

>> BUILDING ON OUR UNPRECEDENTED FOUNDATIONS

A bold new era defined by ambition, innovation, and a fundamental rethinking of what a European bank can and should be

>> TRANSCENDING THE BENCHMARK

To deliver solutions that are fast, intuitive, and always centred on the client, accelerating quality growth in our 13+1 geographies and beyond

>> BUILDING ON OUR WINNING STRATEGY

Combining the scale and trust of a traditional bank with the agility of a technology-driven platform, delivering beyond peers

>> BENEFITTING OUR STAKEHOLDERS

Unmatched trajectory offering the best combination of profitable growth and distributions in the sector

UniCredit Unlimited. A future without limits.

Section 2.2

Text: The new plan will allow us to support c.30bn in the next three years and c.50bn in the next five years, o/w cash dividends at 50% of Net Profit[8], in addition to the 9.5bn related to FY25.

Upgrading our ambition, aiming to:

- Increase Net Profit to c.11bn at a RoTE >20% in 2026

- Grow at 7% CAGR to c.13bn by 2028, increasing RoTE above 23% - and directionally aspire to reach 15bn by 2030, with RoTE at c.25%

[1] FY25 total distribution at €9.5 billion, of which circa €4.75 billion cash dividend (of these, €2.2 billion has already been paid as interim dividend in November 2025, the remaining €2.58 billion, corresponds to a preliminary final DPS of €1.7205

[2] Gross revenues are flat FY/FY when adjusted for circa negative €240 million trading impact related to the hedging of our strategic portfolio, booked in 4Q25, to protect and optimize its return, or circa -1% FY/FY otherwise.

[3] €3.1487 FY25 DPS calculated as €1.4282 interim DPS paid in November 2025, plus €1.7205 preliminary final DPS, calculated as of 6 February 2026, based on the best estimate of the expected number of shares eligible for dividend payment. The definitive final DPS will be communicated according to the ordinary procedure

[4] Including FY24 final dividend paid in April 2025 of €1.4764 and FY25 interim dividend paid in November 2025 of €1.4282, or +11% FY/FY without it

[5] Annualised ratio between (i) Net profit after AT1/Cashes minus excess capital charge and (ii) allocated capital. For Italy, excluding Profit on Investments from Life Insurance internalisation (31.7% including)

[6] Calculated on Group RWA (see end notes for details/definition). For Italy, excluding Profit on Investments from Life Insurance internalisation (4.3bn including)

[7] Excluding Profit on Investments from Life Insurance internalisation (6.4bn including)

[8] Distribution ambitions are calculated assuming: the current 80% ordinary payout and subject to the achievement of plan targets, including organic capital generation. Potential additional distributions from excess capital return or deployment to be assessed annually. All distributions are subject to supervisory, board of directors and shareholders' approvals